Trust

TRUST

Trust is a concern where the property is legally transferred from one person to another on a faith that the latter shall manage the property for the benefit of a third person. Trust is usually created for some charity or religious purpose. It can also be used as a vehicle for investments in the form of Mutual Funds or Venture Capital Funds under the regulation of Securities Exchange Board of India. Various tax exemptions are also available to Public Trusts.

There are two kinds of trust than can be formed-

Public Trust: it is regulated by specific state law. In these trusts, beneficiaries of the trust are uncertain and unidentified body of persons

Private Trust: it is regulated by the Indian Trusts Act, 1882. In these trusts, beneficiaries are specific and identified group of people.

Requisite Documents

- Minimum number of members necessary for-

• Private Trust – 2

• Public Trust – 7

- Maximum 21 members are required on the Board of Trust

- Creation of a Trust Deed to govern the proposed trust

- The legal title of the property shall vest with the trustees

- Registration of trust is not mandatory, in case of-

• Transfer of movable property;

• Transfer of immovable property is through will

- Opening of a bank account in the name of proposed trust

- Maintain separate records exclusively for the receipt and utilization of foreign donations and contributions

- If beneficiary is a non-resident, prior approval of RBI is necessary for registration

- Physical presence of settlor and two witnesses at the time of registration

- Audit of trust under Income Tax Act, 1961 is necessary

- Other applicable registrations-

• TAN Card, if TDS is to be deducted;

• FCRA Registration and separate Bank Account, if desirous of accepting donations from foreign sources;

• GST Registration, if trading and manufacturing of goods and services despite the motive is not to earn profit

Requirements

Name of the trust

Elect the Board of trustees-

• Settlor;

• Managing Trustee;

• Other Trustees;

Summary objects of the trust

Details of trustees-

• Occupation;

• Father’s name;

• Designation;

• Mobile number;

• Email-id

Requisite Documents

Proof of Identity of trustees, settlor and witnesses-

• PAN card;

• Aadhar Card;

• Voter Id Card;

• Passport (necessary if foreigner is a member)

• Driving License

Proof of Registered Office of the proposed trustee-

• Title Deed; or

• Lease/ Rent Agreement and rent receipt; and

• Utility bill not less than 2 months;

NOC from owner/landlord of office premises

Two photographs each of trustees and settlors

Note

- We register trust only in State of West Bengal and Delhi.

- Identity documents should be Self Attested.

- Further, details and documents, if any required, can be called for during the process.

- We too provide Annual Filings of Trust as a separate service.

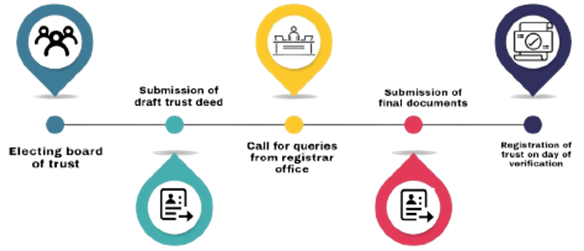

Incorporation Process

Usually it takes 20-25 working days, subject to government approval to get the trust registered.