Charitable Company

CHARITABLE COMPANY

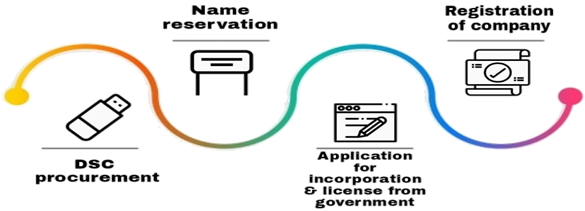

Charitable Company is a non-profit organization that is registered under the Companies Act, 2013 in the name of Section 8 Company. It is a limited company with specified objects like the promotion of commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment or any such other object. Such company operates under the license of the Central Government and is also benefitted with several exemptions and relaxations from complex formalities of a company concern.

Key Points

- The profits earned are to be re-invested for promoting the stated objects

- Prohibited to distribute profits as dividend

- Minimum 2 members are required

- No minimum capital requirement

- Exempted from Stamp Duty registration

- Prior approval of Central government is required for altering the provisions of charter documents

- An HUF or firm may also become a member in Section 8 Company

- Liability of the members are limited

- It mandatory to include any of the following word in the name of the proposed charitable company- Foundation, Association, Forum, Federation, Chambers, Confederation, Council, Electoral Trust or alike.

- Company must have a clear vision and project plan for immediate 3 years

Requirements

- Distinctive name of proposed company (at least 2 names for reservation)

- Summary of the objects of the company

- Director Identification Number (DIN) of proposed directors, if any

- Communication details of directors and subscribers-

• Mobile Number;

• Email-Id

- Address of proposed Registered Office and its nearest police station

- Director and Subscriber Details-

• Personal;

• Occupational;

• Educational Details

- Total amount of authorized and subscribed share capital

- Interest of Directors-

• Details of entities where director has interest;

• Details of interest of director in such entity

- Amount and number of shares subscribed by each shareholder

- Proposed Bank Name

- Corresponding Address, if proposed registered office is not final

- Estimate of annual income and expenditure of the company for first 3 years, specifying-

• Sources of income;

• Objects of the expenditure

Requisite Documents

• NOC of Trademark or;

• Authorized letter of concerned entity

• Title Deeds; or

• Lease/ Rent Agreement and rent receipt; and

• Copy of any utility bill not older than 2 months

Note

- Identity documents should be Self Attested.

- We also provide making and renewal of DSC services.

- Further, details and documents, if any required, can be called for during the process.

- Other requisite documents shall be drafted and finalized by our team for the process and will be requested for signing.

Time Duration

After receipt of all documents and information and subject to the MCA (CRC or ROC) response, approx. 5-8 days is taken for incorporation of such company