Due Diligence

DUE DILIGENCE

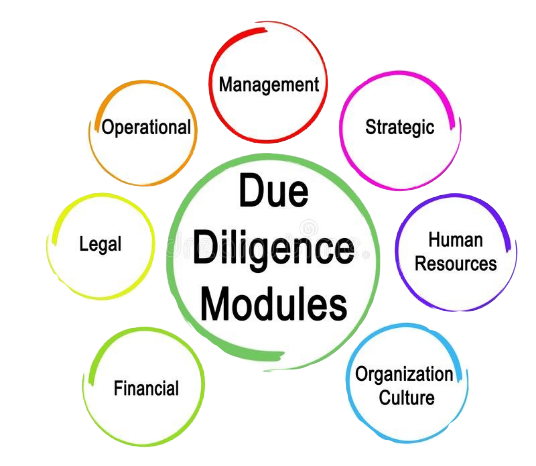

Due Diligence evaluates business activities of a company through investigation and inspection of financial as well as non-financial records. It checks past performance, internal systems, key operational aspects, material facts and analyses risk and opportunities of a proposed transaction. The process determines potentiality of the prospective deal or investment and measures associated risks and costs.

We carry out the entire process precisely using effective tools and ensure assessment of records accurately.

Composition Scheme

- Acquiring a target company

- Merger & Amalgamations

- Sanctioning Bank/PFIs Loans

- Making hefty investments

Investigations under Due Diligence

A. Financial Records:

C. Human Resource:

| B. Legal Aspects:

D. Operational Aspects:

|

Requirements

- Audit Engagement Letter is required to set out the appointment, terms and conditions, etc. in respect to the proposed Audit.

- Permission to inspect all requisite documents, registers, records and forms is mandatory for an independent and true audit report.