Hindu Undivided Family

HINDU UNDIVIDED FAMILY(HUF)

The Joint Hindu Undivided Family concern is not governed under any codified law, but they have to comply with Hindu Succession Act, 1956 and the Income Tax Act, 1961. All the affairs of HUF are managed and controlled by the senior most male member of the family known as Karta who may work in consultation with the other members of the family.

HUF is a considered as a separate entity under Income Tax Act. It enjoys various tax benefits.

Key Points

- HUF is formed by a family having a common ancestor

- Liability in HUF of-

• Karta is unlimited;

• Co-parceners is limited to their shares

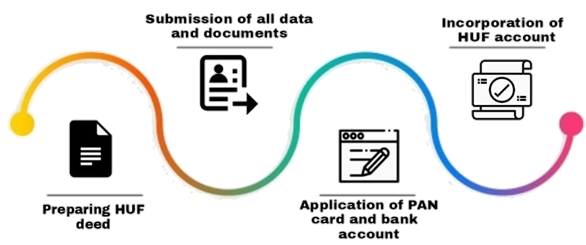

- Creation of HUF Deed is recommended

- PAN Card and a Bank Accout in the name of HUF

- It is taxable as an individual assessee; hence, one can save tax from basic exemption of Rs. 2.5 lakhs

- It attracts deductions under Section 80C of the Income Tax Act, 1961 up to Rs. 1.50 lakhs

- It can take insurance policy on the life of its co-parceners

- Salary expense to members for the functioning of HUF is deductible from the income of HUF

- Gifts in excess of Rs. 50,000 received in a year is taxable .

- Personal assets/funds cannot be transferred to HUF

- Investments can be made from the HUF’s income

Requirements

Capital with which the HUF is to be initiated-

• Any ancestral property;

• Assets gifted by relatives or friends

Requisite Documents

Proof of Identity and Residence of Karta and co-parceners-

• Voter Id Card;

• Passport;

• PAN Card;

• Aadhaar Card;

• Ration Card having applicant’s photo;

• Driving License;

• Bank Account Statement;

• Post Office Passbook

- In case of Minor, any of the above-mentioned documents as proof of identity and address of any of parents/guardians of such minor

- Proof of Birth Certificate of Karta

Note

- We create a Hindu Undivided Family only in States of West Bengal and New Delhi

- Identity documents should be Self Attested.

- Other requisite documents shall be drafted and finalized by our team for the process and will be requested for signing

- Further, details and documents, if any required, can be called for during the process.

- We also provide service of filing Income Tax Return of HUF and other related service.

Time Duration

After receipt of all the documents and subject to government authority’s response, approx. time taken is 5 days.