Limited Liability Partnership

LIMITED LIABILITY PARTNERSHIP (LLP)

Limited Liability Partnership is a corporate business concern being a hybrid of partnership firm and private limited company. It provides the benefits of separate legal entity, limited liability and flexibility in the internal management, based on mutual agreement. It is a suitable vehicle for small enterprises.

For Income Tax purposes, LLP is treated at par with partnership firms.

Key Points

- Minimum 2 designated partners

- Liability is limited to the amount contributed in LLP

- Audit of accounts is required when turnover of LLP exceeds Rs. 40 lakhs or total contribution in LLP exceeds Rs. 25 lakhs

- A corporate entity can become a partner in LLP

- HUF or any person in the capacity of Karta cannot become a partner in LLP

Requirements

- Digital Signature Certificate of designated partners

- DPIN/ DIN of partners, if any

- Distinctive name for LLP (at least 2 names for reservation purpose)

- Significance of the abbreviated or coined name proposed. The details of the vernacular language(s) if used in the proposed name and meaning thereof

- Trademark application number, if any, applied for the name of proposed LLP

- Summary of the main objects

- Details of the proposed LLP-

• Address of the Registered Office;

• Email-Id

Details of partners/ nominees-

• Email Id;

• Mobile Number,

• Occupation;

• Educational Qualification;

• Residential address (current and permanent)

Duration of stay at present address

Details of Contribution by partners-

• Amount;

• Nature of contribution (cash or kind)

- Details of tax saving investment/expenditure

- Details of capital gains, if any

- Details of investments in unlisted shares, if any

- Salary slips, wherever applicable

Requisite Documents

Document supporting the proposed name, if any-

• NOC from Trademark owner; or

• Authorized letter of concerned entity

Sectoral regulatory approval, if any

Proof of address of Registered office of the proposed LLP-

• Title deeds; or

• Lease/ Rent agreement and rent receipt; and

• Utility bill not older than two months

NOC from owner/landlord of office premises

Proof of Identity of both applicants- PAN Card

Passport size photograph of the partners

Proof of Residential Address (whatever available)-

• Voter Id Card;

• Driving License;

• Aadhar Card;

• Passport;

• Bank Statement;

• Utility Bills

Note

- Further, details and documents, if any required, can be called for during the process.

- Other requisite documents shall be drafted and finalized by our team for the process and will be requested for signing.

- We also provide services of Filing Income Tax Return and other related services for the LLP.

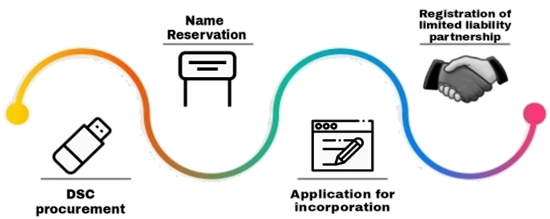

Time Duration

After receipt of all documents and information and subject to the MCA (CRC or ROC) response, approx. 3-7 days is taken for incorporation of such concern.