One Person Company

ONE PERSON COMPANY (OPC)

One Person Company is a corporate entity with only one shareholder and whose legal and financial liability is limited. It is a hybrid of private company and proprietorship. It has a simpler corporate legal regime through various exemptions under the Companies Act, 2013. It encourages corporatization of micro businesses and entrepreneurships where they are not compelled to devote considerable time, energy and resources on complex legal compliances.

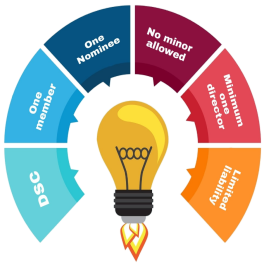

Key Points

- Digital Signature Certificate of shareholder and nominee

- Only 1 member being a natural person and Indian citizen

- 1 nominee of the sole member, being a natural person and Indian citizen

- Such shareholder or nominee should be resident in India for at least 120 days during immediate financial year

- Such shareholder or nominee is not a shareholder or nominee of any other OPC

- No minor can be a shareholder or nominee

- Minimum 1 director

- Cannot be incorporated or converted into Section 8 Company

Requirements

- Address of proposed Registered Office and its nearest police station

- Summary of the objects of proposed company

- Amount of authorized share capital

- Interest of Directors-

• Details of entities where director has interest;

• Details of interest of director in such entity

- Amount and number of shares subscribed by the shareholder

- Proposed Bank Name

- Corresponding Address, if proposed registered office is not final

Requisite Documents

Note

- Other requisite documents shall be drafted and finalized by our team for the process and will be requested for signing.

- We also provide Annual Filings of One Person Company as a separate service.

- We also provide services of Filing Income Tax Return and other related services for the company.

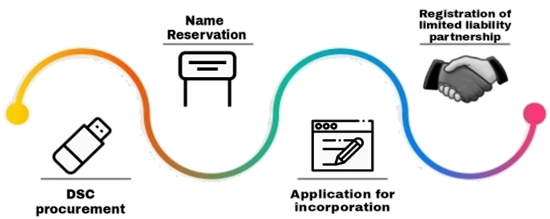

Time Duration

After receipt of all documents and information and subject to the MCA (CRC or ROC) response, approx. 3-7 days is taken for incorporation of such company.