Proprietorship Firm

PROPRIETORSHIP FIRM

In Sole Proprietorship concern, the single owner contributes to all the assets of the business and assumes complete responsibility for all its liabilities and debts. The owner has to arrange the capital for the business and is solely accountable for its management. It does not have any separate legal entity. No complex legal formalities are required to establish it other than appropriate licenses for registration of business name. Also the owner has to report income/loss of this business in his personal income tax return only.

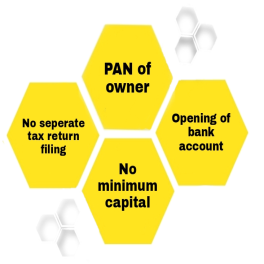

Key Points

- Valid PAN of the owner

- Bank Account in the name of the firm/owner

- No minimum capital requirement

- No separate tax return filing for the firm

- Tax Audit is required when-

• For Business- Turnover > Rs. 1 crore;

• For Profession- Gross Receipts > Rs. 25 lakhs

Requirements

Details of Proprietor-

• Father’s name;

• Email Id;

• Mobile Number

- Name and location of the firm

- Date of commencement of business

- Business activity details

Requisite Documents

- Two colored passport size photographs of the proprietor

- Copy of PAN Card and Aadhar Card

- Cancelled Cheque in the name of proprietor

Registrations and Licenses

Depending upon the nature of business, several other licenses may be required during incorporation. Some of the prominent ones are:

- Trade License

- Shops and Establishment Act

- Professional Tax Act

- GST Registration, if required under GST law

- MSME, if required

We also provide services for obtaining such registrations and licenses.

Note

- Identity documents should be Self Attested.

- Other requisite documents shall be drafted and finalized by our team for the process and will be requested for signing.

- Further, details and documents, if any required, can be called for during the process.

- We also provide other services in relation with Shops and Establishment Registration like Notice for Change in the details of registration or employees, obtaining Duplicate Certificate in case of Loss, Surrender of Registration and others.

- We also provide services of Filing Income Tax Return and other related services for the individual.

Time Duration

After receipt of all the documents and subject to time taken by authorities, approx. 2-3 days is taken for incorporation of such firm.