Secretarial Audit

SECRETARIAL AUDIT

Secretarial audit is an independent verification of compliances of rules and laws applicable on a company. For some companies, Secretarial Audit Report is necessary to be annexed with the Board’s Report.

We carry out the entire audit precisely with thorough checking and ensure assessment of records accurately.

Under secretarial audit process, a professional checks statutory records, books, papers, documents, forms, registers and other necessary information to ascertain compliance of legal and procedural requirements and processes followed by the company. It is an objective assurance activity intended to add value to a company and improve its operations. The periodical audit helps to detect the instances of non-compliances and facilitates taking corrective measures well in time to avoid further risk.

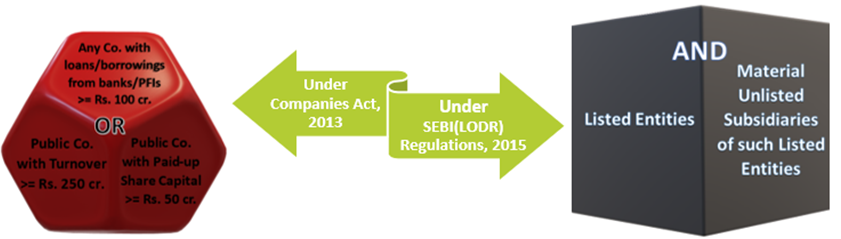

Applicability

The secretarial audit is also applicable to such private company which is a subsidiary of a public company falling under aforesaid prescribed class of companies.

The paid-up share capital, turnover, or outstanding loans or borrowings as the case may be, existing on the last date of latest audited financial statement shall be taken into account.

‘Material subsidiary’ mean a subsidiary, whose income or net worth exceeds ten percent of the consolidated income or net worth respectively, of the listed entity and its subsidiaries in the immediately preceding accounting year.

Note

- Audit Engagement Letter is required to set out the appointment, terms and conditions, etc. in respect to the proposed Secretarial Auditor

- Permission to inspect all the requisite documents, registers, records and forms is mandatory for an independent and true audit report